Millions of Cambodians are facing unprecedented economic hardship as a result of the COVID-19 pandemic.

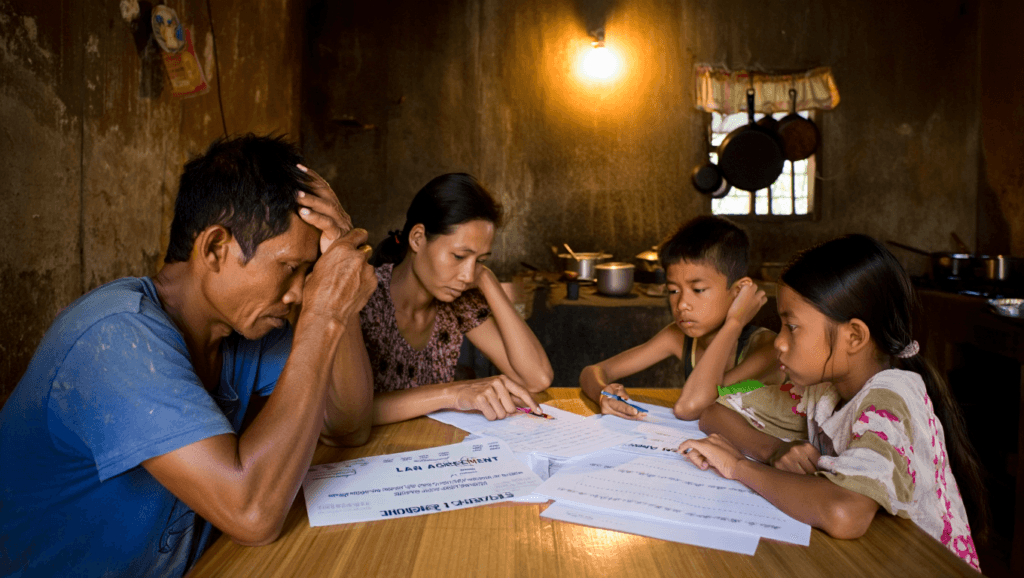

This suffering is being dramatically worsened by the country’s ongoing microfinance debt crisis, which places millions of workers and families at serious risk of losing their livelihoods, health, and land.

More than 2.6 million people in Cambodia currently hold microfinance loans, with an average loan size exceeding USD 3,800 — one of the highest levels of microfinance indebtedness in the world. The vast majority of these loans are secured by land titles, meaning that borrowers risk losing their most valuable and essential asset if they are unable to keep up with repayments.

As the pandemic has caused widespread job losses, wage reductions, and business closures, millions of borrowers are now unable to meet their monthly loan obligations. Without urgent intervention, this situation threatens to trigger a large-scale land dispossession crisis across the country.

Workers in the tourism, garment, food, and service sectors have been particularly affected. Many have lost their jobs entirely, while others face drastically reduced working hours and incomes. Government subsidy programs introduced so far have fallen short of covering basic living costs, leaving families struggling to afford food, housing, and healthcare.

At the same time, Cambodia’s microfinance sector continues to demand regular loan repayments, despite the extraordinary circumstances. The continued enforcement of loan contracts during a public health and economic emergency places an unbearable burden on borrowers and increases the risk of bonded labor, unsafe migration, human trafficking, and other human rights abuses.

CFSWF, together with community groups, unions, and civil society organizations, calls on the Cambodian government and microfinance institutions to take immediate, decisive action.

We urgently demand that all microfinance institutions:

These measures are essential to ensure that borrowers can protect their health and safety during the pandemic without the fear of losing their homes or land. Access to land is critical, particularly as many workers are being forced to return from urban areas or from abroad to rural communities due to job losses.

We acknowledge that the National Bank of Cambodia has encouraged microfinance institutions to consider loan restructuring and deferment on a case-by-case basis. However, Cambodia has more than 80 microfinance institutions, and a case-by-case approach is far too slow and insufficient to address a crisis affecting millions of borrowers simultaneously.

A sector-wide directive is urgently needed. Only a clear and mandatory order from the government and the National Bank of Cambodia can provide immediate and effective relief at the scale required.

Microfinance debt disproportionately affects women, who make up approximately 75% of borrowers in Cambodia. Women also represent the majority of workers in sectors hardest hit by the COVID-19 crisis, including garment manufacturing, tourism, food services, and informal employment. As incomes disappear, women face increased economic insecurity, while still being held responsible for household debt repayment.

The microfinance sector has argued that suspending repayments and returning land titles would negatively affect its financial stability. However, Cambodia’s microfinance industry remains highly profitable and is largely owned by foreign entities, including international financial institutions and development banks. These institutions have far greater access to capital and risk mitigation tools than the average Cambodian household.

In many other countries, microfinance institutions operate without using land titles as collateral. Cambodia’s reliance on land-based collateral is both unnecessary and dangerous, particularly during a national emergency.

At a time when millions of people are worrying about their next meal, they should not also have to fear losing their land because they cannot make a monthly loan payment.

CFSWF strongly urges the Cambodian government, the National Bank of Cambodia, and all microfinance institutions to prioritize the health, dignity, and livelihoods of workers and borrowers by immediately suspending loan repayments, halting interest accrual, and returning land titles to their owners.

Failure to act now will deepen inequality, fuel poverty, and cause long-term damage to Cambodia’s social and economic fabric.

Your support helps food and service workers organise, defend their rights, and improve working conditions through solidarity and collective power.